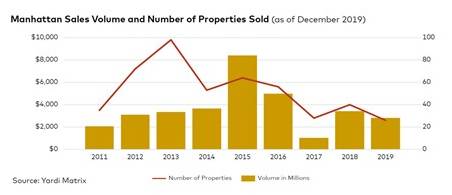

Although pained by affordability issues and decelerating investment activity, the borough's multifamily sector remained on course going into 2020.

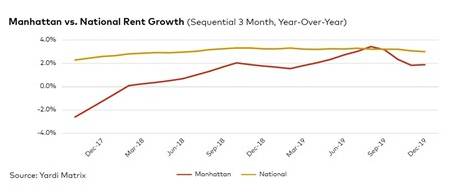

Mirroring nationwide trends, Manhattan’s multifamily sector topped off a strong 2019 with a tepid fourth quarter. While the borough remained the country’s most expensive rental market, rates were up 1.9 percent last year and occupancy stood at 98.3 percent as of November, down just 20 basis points in a 12-month period.

New York City gained 77,300 jobs in the 12 months ending in November 2019, with education and health services accounting for more than 75 percent of this growth. The metro’s economy softened slightly, but a flurry of proposed skyline-altering high rises will join a list of developments including the $25 billion Hudson Yards, Tishman Speyer’s 2.8 million-square-foot The Spiral, Brookfield’s $5 billion Manhattan West and SL Green’s 1,400-foot-tall One Vanderbilt. As of mid-January, Manhattan had more than 20 million square feet underway in office projects alone.

Multifamily development shifted down a gear in 2019. Only 2,363 units came online, below the 3,890 apartments that were delivered in 2018 and less than half the 5,893-unit cycle high recorded in 2017. Considering the current pipeline and the borough’s strong demand for upscale rentals, we expect rent growth to remain steady, but below the national average, in upcoming quarters.