After concentrating on Seattle's urban core where most new projects are located, multifamily investors expanded their horizons in 2018 and placed more capital in suburban areas, where rent growth has been strong. As a result, suburban areas matched up with, and even outperformed their downtown counterpart, helping to drive apartment sales volume in the Seattle metropolitan area in 2018.

Analyzing the top performing suburbs in Seattle in terms of sales volume, Federal Way, Renton and Tacoma were three areas that saw some of the highest sales levels in the Seattle area as investors from all over the country scoured the market for areas that have experienced strong population growth.

Vacancy rates found in several of Seattle's suburban multifamily submarkets are well below the market average, cap rates, rate of return, are significantly higher than the 10-year treasury rate and rent growth is higher than the metro area average.

One of the biggest was Griffis Residential's acquisition of the 880-unit Griffis Lake Washington, in Renton near Boeing facilities and Southport Office Campus, a new office development that will bring luxury office space to the area. Fairfield Residential sold the property in September for $282.5 million or $321,000 per unit, at a 4 percent capitalization rate.

Other investors were drawn to more affluent suburbs on Seattle's north shore or Eastside. Los Angeles-based Decron Properties made its first splash in the Seattle area with the acquisition of the 558-unit Avana 522 in Bothell's North Creek neighborhood, a biotech hub. Blackstone sold the apartments for $173 million or $310,000 per unit, at a 4.2 percent cap rate. After closing on that acquisition in in October, Decron hinted that it is interested in investing more in the Puget Sound region.

Bellevue is another Seattle suburb that courted various investors drawn by the rapid tech growth in that submarket. The area saw its largest apartment sale in early December when a publishing executive paid $150 million or $486,000 per unit at a 4 percent cap rate, for the 309-unit Sparc complex.

The deal involved the first major development in the Spring District, a former industrial area located between downtown Bellevue and Microsoft’s headquarters in Redmond that has recently emerged as a major tech hub following Microsoft's decision to implement a massive expansion of its campus.

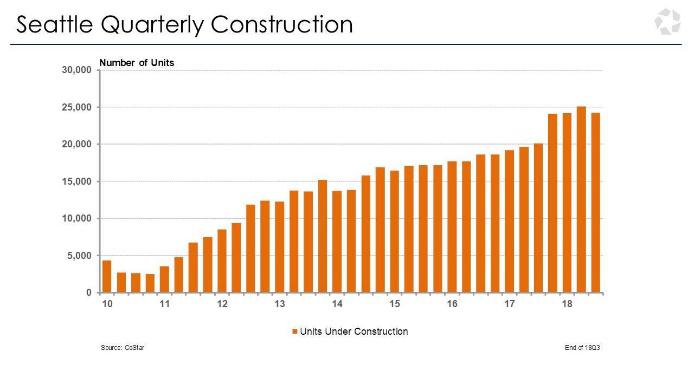

What does the future hold for the Seattle apartment market? Developers continue to inundate the urban core with new supply of high-end rental units at a rate never seen in the market before. With roughly 25,000 units under construction, supply pressures will be heaviest in downtown Seattle and surrounding neighborhoods.

Rent growth in the downtown multifamily market could rebound if supply levels are cut in half, as they were several years ago. However, it is very likely that multifamily investment will remain strong in Seattle's suburbs as more investors search for higher yields, especially with interest rates on the rise.