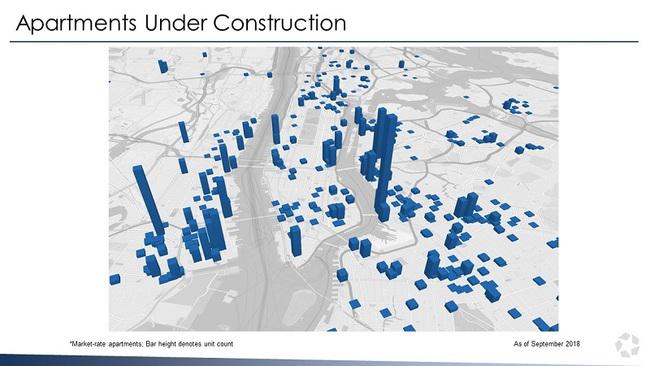

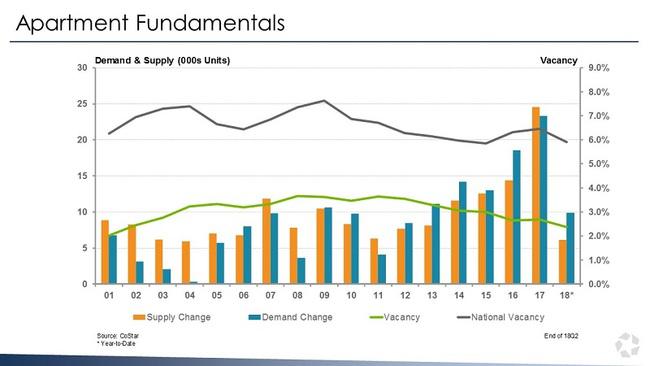

More than 45,000 apartment units have been added to the greater New York market since 2016, and multifamily vacancies remain below 3 percent, suggesting a healthy appetite for more. And another supply wave is coming, as more than 60,000 units are under construction in metropolitan New York, with about 7,000 of those concentrated in Long Island City.

The total new construction represents less than a 5 percent change to the market’s inventory. Due to construction delays, many of these units are likely to deliver over a longer span of time than areas like Dallas, where more than 60,000 units have delivered since 2016 and another 37,000 units are under construction.

The influx is not without some pain. At the top of the market, landlord concessions, once a rarity, are now becoming common in New York. Almost 15 percent of all New York market-rate units are offering one month free rent. But the market softness is relative; New York still accounts for 11 of the nation's top 15 most expensive submarkets.

For those buying and selling buildings, a low-interest-rate environment and global uncertainty are supporting lofty valuations across the market. The market’s average price tops $300,000 per unit and cap rates have compressed to around 5 percent. Although, a price of $500,000 per unit and 3 percent cap rate are not uncommon in New York. Still, returns on residential investment in New York are relatively good compared with yields on government-issued bonds both in the market and in countries like Germany and Japan.

With a strong economy, the impressive demand for New York rentals should continue. The Bureau of Labor Statistics reported in August 2018 that the New York metropolitan area had the largest year-over-year employment increases when compared to other large cities.

The financial sector, a key driver of the City’s economy, continued to perform strongly because of higher interest rates, lower corporate tax rates and deregulation. Net income after taxes for the top seven banks in the U.S. rose to $30.9 billion in the second quarter of 2018, 16.8 percent higher than the same period of 2017.

Strong growth in bank profitability was driven by modest growth in pre-tax income and a steep decline in taxes. Corporate earnings got a boost from the Tax Cuts and Jobs Act of 2017. And in better news, according to the NYC Comptroller, because New York City is a service oriented economy, the repercussions of tariffs on goods should be minimal, if any affect at all.