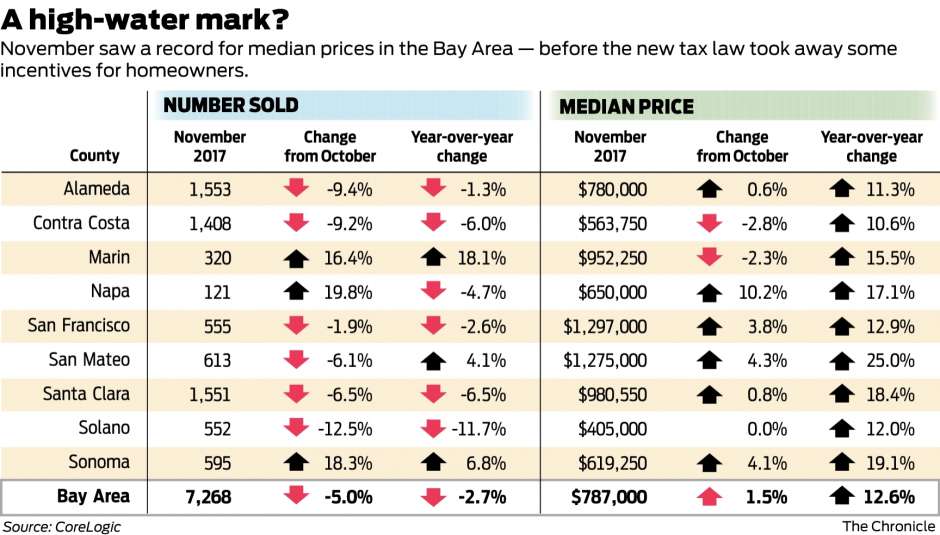

The median price paid for a new or existing Bay Area home or condo hit a record $787,000 in November, up 1.5 percent from a revised $775,000 in October and up 12.6 percent year over year, according to a CoreLogic report issued Thursday.

Some say that could turn out to be a high-water mark until buyers and sellers sort out the impact of the federal tax overhaul, which eliminates some tax benefits of homeownership. Others say the bill won’t put enough downward pressure on the seemingly insatiable demand for Bay Area homes to cause prices to fall.

“I think it’s going to be wait and see in January and February,” said Michael Barnacle, managing broker of the Zephyr Real Estate office in Pacific Heights. “We have had some evidence in recent weeks of people deciding they weren’t going to sell as a consequence of the new taxes.” They might be worried that they will have to pay higher property taxes on a new home, yet be able to deduct less of them, if any.

Buyers, especially first-timers, “are probably going to hold off until they can entirely figure out the whole rent-versus-own situation as a consequence of the tax changes,” Barnacle said.

Ultimately, most people he talks to expect “lower but steady appreciation,” but in the short term, prices may plateau “until people figure this out,” he said.

On the other hand, Gregg Lynn, an agent with Sotheby’s International Realty in San Francisco, has seen no impact from the new tax bill. “San Francisco has the most constrained inventory of any housing market in the continental United States. There are still a lot of people moving here,” many to work in technology. “We are seeing no sign of that abating.”

In November and December, he said he signed up eight new clients who want to list their homes for sale in January. Their reasons ranged from a second home no longer being used, death of a grandparent, moving to a smaller or larger place or an investment property being sold. “All of these are normal life-cycle reasons, he said.” Over the last two weeks, “we have put four buyers into pending contracts,” including three who are relocating here for jobs.

The tax bill “is not affecting anybody’s decisions so far,” Lynn said. “I don’t think it will put upward or downward pressure outside the normal constraints of supply and demand in our market.”

If the bill does have any impact, it won’t be seen in CoreLogic’s monthly housing report for some time. It’s based on data from county recorders’ offices and generally reflects sales that were entered into weeks earlier.

President Trump signed the tax bill only a week ago and almost all of the changes don’t take effect until 2018.

The new law generally lowers tax rates, but some people could still pay higher taxes if the loss of deductions and exemptions pushes their taxable income higher.

There are two big changes directly affecting homeownership. Under the new bill, homeowners can deduct interest on up to $750,000 in mortgage debt used to buy or improve one or two homes. That’s down from $1 million under the old law. The new rule applies to mortgages taken out after Dec. 14, 2017. Older loans are grandfathered in under the old limits. (Homeowners can refinance these older loans up to $1 million and still deduct interest as long as the balance on the new loans is not bigger than the balance on the old one — in other words, if you’re not doing a cash-out refinance.)

In addition, the final bill repeals the itemized deduction for up to $100,000 in home-equity debt not used to buy or improve a home, including existing home-equity loans and lines of credit.

Starting next year, taxpayers who itemize can deduct a total of $10,000 in all state and local taxes combined. This includes state income and property taxes. Today, taxpayers who itemize can deduct all of their state and local taxes, unless they are in Alternative Minimum Tax, which disallows the deduction.

People who can afford to buy a home in the Bay Area could easily pay more than $10,000 a year in state and local income and property taxes combined. The tax on a newly purchased $1 million home would be more than $10,000 by itself.

In a win for homeowners, the final bill preserved the existing rules that apply to capital gains tax on a primary residence. Homeowners pay no tax on the first $250,000 of capital gains ($500,000 for married couples) as long as they have lived in the home as their primary residence for at least two of the past five years before the sale date. The Senate version of the bill would have changed that to five of the past eight years, but it was stricken from the final bill.

If the tax bill has an impact, it’s most likely to be on homes priced between $900,000 and $2 million, said Andrew LePage, a CoreLogic research analyst.

Above $2 million is speculation, but below $900,000, the loan amount with 20 percent down would be less than $750,000 and the interest would be fully deductible.